Local expertise with UK wide coverage

We are committed to supporting SMEs through local relationships.

Bespoke funding for established SMEs

SME Capital was founded to support the growing number of SMEs who face difficulty or frustration in accessing capital through traditional methods. We understand the importance of real and trusted relationships in the lending market and have dedicated Regional Directors based across the UK. By combining traditional lending expertise with the latest in data analytics, we are supporting established UK SMEs with their long-term objectives and business ambitions.

The market we serve

SME Capital provides funding for mid-size businesses which are integral to the UK economy. We support UK businesses able to demonstrate recurring revenues and a track record of profitability. They often have unique needs that fall between traditional lending routes and the automated response from online only lenders. We cater to businesses with strong cash flows, assessing each business on its strengths, rather than focusing on the asset base.

Credit Philosophy

Local relationships at our core

We have regional experts ready to support you locally.

Holistic approach to credit

We take the time to really understand your business and strategic plans.

Bespoke structures

We offer flexible amortisation structures including capital repayment holidays.

A local partner, who knows your region

SME Capital has an ever growing team of funding experts based across the UK. We are set up to become long-term partners with local businesses and their intermediary advisors. Your Regional Director will be the first person you speak with and who will guide you through the funding process to completion and drawdown. They will continue their relationship with you through ongoing servicing of the loan and future events.

Meet the team

We are ready to discuss your financing requirements

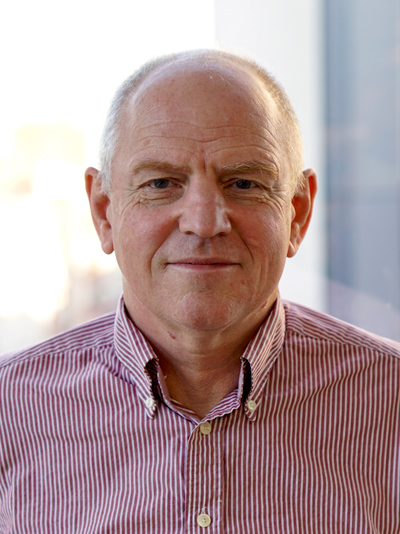

Colin James

Co-Head of Origination, South West

Colin has over 25 years banking experience in Bank of Scotland and Barclays in roles encompassing Commercial and Corporate Banking, Leveraged Finance and Equity Investment.

As part of HBOS Integrated Finance, Colin led MBOs and other equity transactions and at Barclays he led the South of England debt team, providing debt to SMEs.

Mike Millington

Regional Director, Midlands

Mike has a wide range of SME banking experience having worked in the Mid-market and Commercial banking space for RBS, NatWest, Thincats and recently as a broker with Swoop Finance.

Mike has over 30 years banking experience in supporting businesses across the Midlands finding the right funding solutions for clients.

Alistair Dalzell

Senior Advisor and Chair of Credit Committee

Alistair took over from Peter Stevens as Chair of Credit Committee in 2022. He is the ultimate decision maker on credit approvals.

Alistair has an extensive career in Investment, Corporate and SME banking gained in both the UK and USA. He was previously Head of Credit for the RBS England and Wales and NatWest business that was to become Williams & Glyn. His experience includes establishing and developing Credit Risk functions, spearheading strategy and change programmes, negotiating business sales, including addressing staff T&C's with suitors, staff and Unions, being a constructive member of the Business and Risk Leadership Boards and, as appropriate, an interface with PRA (Prudential Regulation Authority).

Daniel Rodrigues

Head of Credit

Daniel joined SME Capital in 2017. He is focused on credit assessment, deal structuring and transaction execution, and is involved the ongoing development of our credit processes.

Prior to SME Capital, Daniel worked as Credit Officer in Leveraged Finance and High Yield at UBS Investment Bank before transferring to the Leveraged and Acquisition Origination team. As a Credit Officer he prepared credit approval and approved Leveraged Finance and HY transactions within delegated authority. Prior to UBS, Daniel worked at Fortis Bank and CIBC markets in the Portfolio Management team in Leveraged Finance.

Daniel holds an MSc (equivalent) Business Administration degree from the Universidade Católica Portuguesa, Lisbon

James Kaberry

Non-Executive Chairman

James co-founded SME Capital in 2014. Now as Non-Executive Chairman he works with the Board to oversee the delivery of the vision to be the go to lender for UK SMEs

James developed an acute understanding of the SME market in his role as CEO of Pantheon Financial Ltd, one of the UK’s largest IFA groups which he founded in 2000. James subsequently sold it to Friends Life in 2007 before repurchasing it in 2010 and reselling again in 2017.

James is a serial entrepreneur having been involved with multiple companies from the outset, ranging from wind farms to successful web applications.

Kate Kennedy

COO

Kate joined SME Capital in 2019 as COO, overseeing business operations, new channel and product development.

Kate has over 20 years’ experience leading teams globally in Managing Director, Commercial Strategy and Digital roles in Financial Services and Consumer sectors. She also advises CEOs and Boards. Most recently she was Chief Digital Officer and Strategy Director at Travelex. Previously she was management consulting retail businesses such as WHSmith and Bain & Co.

Mike Ellwood

Strategic Advisor

Mike is strategic advisor to SME Capital. A senior banker with over 30 years experience in structured finance, he had significant spells with RBS as Managing Director for Mid Market Structured Finance and Santander, where he built the UK Corporate and Commercial Banking business to £20bn of assets, including £1bn in their Growth Capital offering.

Mike now has a portfolio of Chairman and Non Executive Director roles across a variety of sectors.

Robert Hulse

Head of Channel Development

Rob joined in May 2022 and has been in financial services, helping SMEs achieve funding since 2005.

He has a breadth of experience across multiple financial products and has developed and led multi-channel origination teams within several alternative lending organisations. His passion is working with SMEs directly and building relationships with business introducers such as Brokers and Accountants. He has extensive experience providing funding opportunities for startups, fast-growing companies, and established SMEs.

Our platform and analytics

We support our local relationships and traditional underwriting with proprietary technology, including timely risk and trend analysis, in order to create bespoke funding structures without compromising.

We have streamlined the application process with key inputs overlaid with data analysis, to give borrowers an early but clear indication of price, structure and loan size.

“We are flexible and relationship driven whilst using smart technology to enhance our credit process. In a sense we've gone back to traditional banking practices of really getting to understand borrower's needs and tailoring the loan structure accordingly.”

- James Kaberry, Executive Chairman

Looking for funding?

Start today.

Our funding partners

At SME Capital, we support owner-managed and local businesses in taking the next step in their evolution, whether that be growth, acquisition or succession. We’re very pleased to work with high quality investors, like SCIO and Prytania, who share our conviction that SMEs are core to the post-pandemic recovery, innovation and establishment of strong local and national economy here in the UK.